Deputy President Rigathi Gachagua has promised to address the issue of double taxation faced by Kenyans abroad when investing in Kenya. He made the statement while on a trip to Botswana where he met with staff at the High Commission in Gaborone to better understand their needs. Gachagua noted that he would present the issue to the Cabinet for further deliberation and decision making. In addition, he encouraged Kenyans living abroad to safeguard and secure their welfare while away from home.

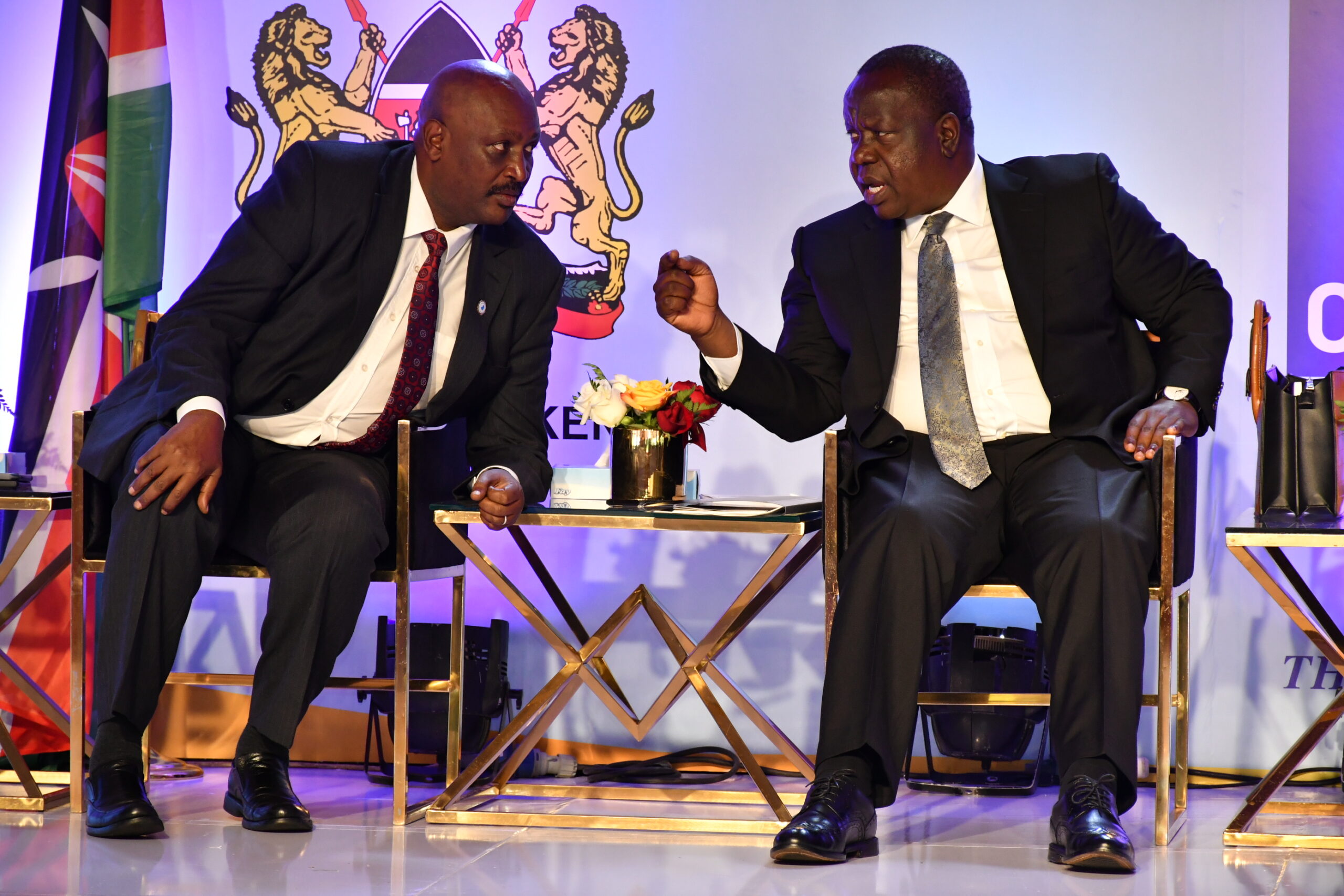

During his visit, Gachagua met with the Kenya Botswana Diaspora Association and commended them for the wonderful job they are doing for their members. He was accompanied by Public Secretary Njogu who has been able to listen to the concerns of people under her Diaspora Affairs Department.

Gachagua also met with two Kenyan footballers pursuing their careers in Botswana and signed with Gaborone United, a professional sporting club. The Deputy President lauded their determination and encouraged other young Kenyans to use their talents and pursue their dreams.

The issue of double taxation has been a significant concern for many Kenyans living abroad who want to invest in their home country. Gachagua’s promise to address the issue is a welcome development for the Kenyan diaspora community.

The Deputy President’s visit to Botswana has demonstrated his commitment to engaging with Kenyans living abroad and understanding their needs. This will hopefully lead to more initiatives that support and encourage Kenyans in the diaspora to continue investing in Kenya.

In conclusion, Deputy President Rigathi Gachagua’s promise to address the issue of double taxation of Kenyans abroad is a significant step in supporting and encouraging investment in Kenya. The visit to Botswana has demonstrated his commitment to engaging with the Kenyan diaspora and understanding their needs.